Hero Motors | Auto

March 27, 2019

Hero Motors

HOLD

CMP

`2,580

Building Blocks for Future

Target Price

`2,870

Hero Motors, one of the largest player in the Industry in the two-wheeler industry

Investment Period

12 Months

(38% market share as on FY2018); has been facing strong headwinds after its break-

up with Honda. The company has been underperforming the industry growth; in spite

of strong business fundamentals- like product basket, branding & strong distribution

network. The key reason behind its underperformance has been the missing links like

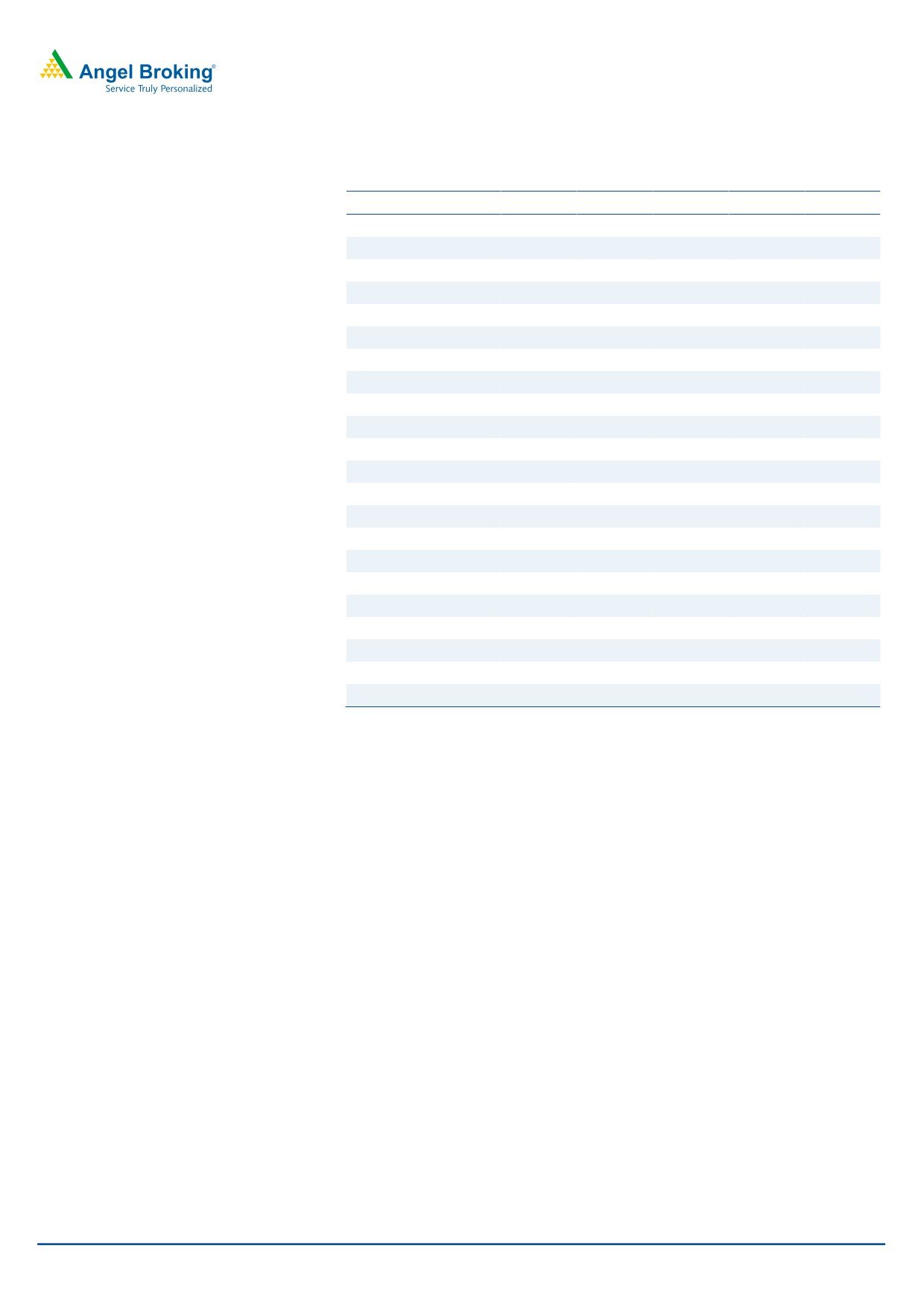

Stock Info

no main product in the premium / scooter segment and very less aggression in

Sector

Auto

expanding the export markets. At this stage, the company is building blocks for future

Market Cap (` cr)

51,524

by investing in missing blocks to make sure that it emerges in next 4-5 years as a

Net Debt (` cr)

(6,395)

complete two wheeler player, having products across market segments. Thus, we

Beta

0 .9

recommend a HOLD.

52 Week High / Low

3862/2545

Avg. Daily Volum e

11,221

Two-Wheeler space in a moderate growth space: Indian Two wheeler Industry

Face Value (`)

2

BSE Sensex

38,233

that mirrors the Indian GDP growth has been growing at a CAGR of 8.1% (FY2011-

Nifty

11,483

2018) in volume terms (23mn at the end of FY2018). However, in the short and medium

Reuters Code

HROM.BO

term, the industry is sensitive to the monsoon trends, rural income, inflation,

Bloom berg Code

HMCL.IN

government policies, crude, and interest rates & amongst others, the regulatory

compliance like the BSVI norms, which will be implemented in India by FY2021. Going

Shareholding Pattern (%)

into FY2020E, the growth in the industry is likely to come in close to mid to high single

Prom oters

34.6

digits (i.e a growth of 5-8%).

MF / Banks / Indian Fls

17.3

FII / NRIs / OCBs

40.2

Hero Motors; inventing for future: Over FY2018-20E, the company will post a

Indian Public / Others

7 .9

CAGR of 7.8% in sales terms. On net profit front, we expect the company to deliver a

flattish performance during the period. The stock, has on the other hand has

Abs .(% )

3m

1 yr

3 yr

witnessed, a strong de-rating and trades now at 3.7xFY2020E BV (including cash &

Sensex

7 .2

15.6

53.2

Investments). However, to protect a further de-rating the company has to exhibit all

Hero Motors

(19.0)

(25.9)

(9.4)

the characteristics of a leading player, which implies that its R&D efforts have to

fructify, which should happen in next 4-5 years). In addition, company’s strong balance

sheet and high ROE of business, enables higher dividend payout and should restrict

the underperformance from here on, even for long-term buyers. Thus, we

recommend a HOLD.

3-Year Daily Price Chart

4,500

Key financials (Consolidated)

4,000

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

Net sales

28,610

32,458

34,655

37,739

3,500

% chg

0.5

13.4

6.8

8.9

3,000

Net profit

3,452

3,576

3,402

3,605

2,500

% chg

14.5

3.6

(4.9)

5.9

EBITDA margin (%)

16.0

16.4

14.5

14.8

2,000

EPS (`)

172.9

179.1

170.4

180.5

P/E (x)

14.9

14.4

15.1

14.3

P/BV (x)

5.0

4.3

4.0

3.7

Source: Company, Angel Research

RoE (%)

36.1

32.1

27.3

26.7

RoCE (%)

39.6

39.3

32.8

34.0

Sarabjit kour Nangra

EV/Sales (x)

1.8

1.6

1.5

1.4

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

11.3

9.7

10.2

9.2

sarabjit @angelbroking.com

Source: Company, Angel Research; Note: CMP as of March 26, 2019

Please refer to important disclosures at the end of this report

1

Hero Motors | Auto

Two-Wheeler space in a moderate growth space (FY2018-21)

Indian Two wheeler Industry that mirrors the Indian GDP growth has been growing at a

CAGR of 8.1% (FY2011-2018) in volume terms (23mn at the end of FY2018). Domestic

markets occupied a major chunk of the same (almost 88% of the volumes) delivering a

CAGR of 8.0%, while exports (12% of the volumes) delivered a growth of almost 9.0%;

albeit on a smaller base. Overall Two-wheeler industry occupies around 81% of the

market share of overall domestic Auto Industry. Going forward the trend is likely to

persist as the Industry still have levers, which will aid the Industry to grow in line with

the GDP growth.

Long-term drivers are intact

Two-wheeler Industry has been minoring its GDP growth. With Indian economy likely

to continue to grow at 7-8% in real terms in near term, Two-wheeler Industry can easily

mirror this growth. All the key levers i.e urbanization, improvement in technology,

increased financial access and increased women participation, will enable the Indian

GDP to grow at fast pace. Two-wheelers penetration in India is still lower at 102 bikes

per 1000 people, which is lower than its Asian peers also, like Thailand & Indonesia,

where the 2Wheeler penetration is 291 & 281 respectively. Even Malaysia has a higher

penetration at 166 bikes per 1000 people. If we were to dissect the two- wheeler

penetration in India, much of the growth has come on back of urban population, which

forms 60% of the industry volumes and has a penetration of 40-45%, while rural India,

which forms 40% of the volumes, has penetration levels of 20-25%, taking the average

Indian penetration levels at 30-40% per household. In addition, if you dissect the market,

around 51% of bike customers are first time buyers, 27-28% are replacement buyers

and 22% are additional bike buyers. Thus, this leaves a lot of scope for the Two-wheeler

industry to post a robust growth; at least in line with GDP growth.

However, if you dissect the Two-wheeler industry in terms of products, it is the

Motorcycles, (which at 15mn at the end of FY018 constituted almost 66% of the

volumes) posted a moderate growth of 5.3% during FY2011-2018. Major chunk of the

growth came in through Scooters (which at 7mn at the end of FY2018 constituted 31%

of the volumes), posted a growth of 18.8% during FY2011-2018. Moped, which is a

minor constituent (3.8% of the overall volumes); underperformed growing at 3.2%

during FY2011-2018. In Motorcycles, the growth was visible in the economy & premium

segments, while posted a CAGR of 10.2% and 11.5% respectively, while the economy

segment remained flat ( data pretending to FY2013-2018).

Near term hiccups to impact growth

However, in the short and medium term, the industry is sensitive to the monsoon trends,

rural income, inflation, government policies, crude, and interest rates & amongst others,

the regulatory compliance like the BSVI norms, which will be implemented in India by

FY2021.

This was already visible in FY2019, where the long-term trend saw a reversal V/s FY2018.

The motorcycle segment gained ~200 bps share in 10M FY2019 in two-wheeler pie

whereas it had been steadily losing share to scooters over the past ten years.

Motorcycles grew at a faster pace than scooters in 10M FY2019 driven by the strong

volume growth of entry-level motorcycles. In scooters, the traditional 110cc scooter

growth faltered but the newly launched, feature rich 125cc scooters drove the growth

March 27, 2019

2

Hero Motors | Auto

of the segment. Mopeds also staged a comeback this year with 3.6% growth in 10 Month

FY2019 whereas in FY2018 they had de-grown by 3.5%.

Going into FY2020E, the growth in the industry is likely to come in close to mid to high

single digits( i.e a growth of 5-8%), driven again by rural economy, improved disposable

income, moderate inflation. In addition, it places bets that the political scenario remains

stable and monsoons are normal and well spread through India. In addition, FY2020

could also witness a pre-buying, as most companies believe before the BSVI is

implemented in FY2021E. Moreover, the growth is likely to be very much back ended i.e

visible during 2HFY2020. Thus, FY2021, forecasted is highly sensitive to the economic

scenario panning out as BSVI implementation (effective April 2020), could easily add up

to 6-8% to the overall cost of the ownership. Moreover, this will be the first for the

Industry, as Industry interactions have pointed out that it is the first time in the world

that the Two -wheelers are expected to comply with the BSVI Regulations. However,

BSVI norms will be beneficial, as it will bring down the pollution emission by 90%. The

ABS norms to be implemented, will not impact the Hero Motors as its for bikes more

than 125CC, and Hero’s only bike in the space higher than that is Xtreme 200, which is

already ABS compliant .

Margins; should remain in line with FY2019 levels

Over FY2014-17, the margins have remained more or less in the range of 14%-18%.

Barring few quarters, in between the Industry has witnessed a good times with soft

commodity starting from FY2016- until date. In FY2019, the Industry has seen some

impact of the rising raw material prices on the OPM’s, especially during 1QFY219 and

3QFY2019. As, of now the key raw materials like crude, steel and Aluminum have

witnessed a softening of prices and are at levels, which should not to be threat in terms

of a pass through for the companies. Generally, the Two-wheeler companies take hikes

of 1-2% yoy, much below the inflation levels. Thus, the industry is unlikely to achieve a

severe price cuts or even high inflationary pressures sustainably over a long period &

hence in long term such margins in the range of 14-16% is sustainable for the Industry.

However, given that most of the company could witness sales growth mostly in line with

FY2019, the margins could settle at around 16-17%.

Hero Motors; inventing for future

Largest Player in the Indian Two Wheeler market

Hero Motors dominates, the Indian two-wheeler market, enjoying a market share of 38

%( as on FY2018). However, there has been a major shift in the market share of Hero

Motors post its split with Honda. The overall market share of the company has declined

from ~43% in FY2013 to around 36% as on 3QFY2019. However, this is more to do with

the shift of the consumers towards the scooter market, which was created and till now

is dominated by Honda, through its Brand Activa. This also evident from the fact that,

scooters contribute around 31% of the overall market in FY2018 V/s 16% of the market

in FY2011.

In Motorcycle market, the Hero still dominates with market-share of 50% as on

3QFY2019 V/s 53% in FY2013. During FY2018, Hero had a market share of 52%. Thus,

the price cuts taken during the year by Bajaj Auto in FY2019 in the economy segment

of Motorcycle segment; lead Hero loss its market share in the segment. In the economy

March 27, 2019

3

Hero Motors | Auto

segment the company had a market share of 59% as on FY2018, which on back of

aggressive pricing of Bajaj Auto; came down to around 53.1% as on 3QFY2019. Economy

segment overall contributed around 26% of the overall domestic Motorcycle market.

In the executive segment, Hero Motors has a major dominance, having a market share

of almost 70% as on FY2018. This segment has witness steady rise for the company. In

FY2013, the company had market share of around 62%. However apart from these two

segments, the company’s presence has been almost zero in the premium segment and

company has fully lost the opportunity to participate in the segment (it had 3% market-

share in the premium motorcycle segment as on 3QFY2019). Apart from these

disruptions, the Motorcycle market had been stable for the players, with TVS & Honda,

being other players. Though there is a competition, the companies with strong hold are

holding on to their market-share on back of strong brand franchises.

In the Scooters market, Honda’s dominance is clear; Honda holds almost 57% of the

overall domestic scooter market as on FY2018. Other key player in the market is TVS

Motors, which has enjoyed a market share higher than Hero Motors at around 15-16%

and had been steady player in the segment. Hero Motors has enjoyed a market share

of 11% as on 3QFY2019V/s 19% it enjoyed in FY2013. Thus, Hero even though was

strong player lost to the competition because of not reading the market well and not

having strong product basket in the segment. In addition, unlike other players, which

have grown at strong growth on back of the exports Hero Motors exposure to the

exports have been minimal at ~3%. Thus, overall Hero Motors has maintained its

dominance because exports of the Motorcycle segment posted a CAGR of 7.7%, while

exports of scooters posted a CAGR of 29.8% during FY2011-2018. Overall exports for

the whole industry stood at 12% as on FY2018.

Thus, overall Hero Motors has dominated the landscape of the Two-wheeler Industry,

on back of its stronghold in the economy and executive segment ( through Splendor

and HF brand franchisee), though at the cost of underperforming the overall growth in

the Industry.

Banking on Rural & new product launches; exports a weak link

Hero Motors, unlike its peers drives almost 50% of its volume sales through rural India

and has a strong dealership network (6,500+), which has aided its leadership position in

the Two-wheeler Industry. Going forward, the company is planning to invest in bridging

the product gap that it has; either launching new products in the segments like Scooters

& Premium Motorcycle segment. It has already invested around US$125mn in setting

up an R&D Center at Jaipur and spends around 1.5-2.0% of its sales on R&D, which is a

big amount been invested by an Indian two wheeler company in the R&D set-up. Led

by Dr Markus Braunsperger (CTO)/ 25 years of R&D experience in BMW, Germany.

Engaged 700+ automotive experts with global, regional expertise across 6 nationalities.

Company plans to launch at least 1-2 products every year for next 4-5 years and plans

to capture market share of around 15-18% in each category; though addressing

products across the 200-400CC premium category, as well as a scooter in the 125Cc

space. In FY2019, the company had launched Xtreme200CC and Destini I, which so far

have failed to capture a major share in the respective segments. Launch of Destini in

Oct’2018 helped capture ~10% market share in the 125cc scooter segment at retail level.

March 27, 2019

4

Hero Motors | Auto

Thus, its imperative for hero motors to capture this market; in order to maintain its

dominance in the Industry along with outperform/ grow in line with the Industry.

In addition, the company has invested in Ather energy- a startup, investing US$31mn,

for a 30% stake in the company. The company is already launched the premium EV

scooters in India. As of now, company does not plan to take the product on board. As

per its own EV strategy; the company plans to own in-house expertise to develop own

EV products.

Margins likely to remain range-bound around 14-16%

Inspite of spending on R&D, company expects Hero Motors to maintain its margins in

the range of 14-16%. Apart from the fixed costs, the raw material costs, which have a

bearing on the OPM, is expected to soften and the results of the same are expected to

reflect by 4QFY2019. However, during FY2020, we expect the margins to remain similar

at around 14.4% V/s 14.8% in FY2018, as we conservatively built the volume growth to

be bit similar to FY2018, with little perk-up in volumes on back of pre-buying before BS6

implementation. Thus, on a long run the company can deliver margins in the range of

14-16%, unless the competitive intensity increases.

Valuations & Outlook

Over FY2014-18, company posted a sales and net profit CAGR of 6.5% and 17.1%

respectively. Volume growth during the period was 5.0%. Over FY2018-20E, the

company is expected to post a CAGR of 7.8%, aided by a 7.0% CAGR in volume terms.

On net profit front, we expect the company to deliver a flattish performance during the

period, as we expect the margins to be under pressure. The stock, has on the other hand

has witnessed, a strong de-rating and trades now at 3.7xFY2020 BV (including cash &

investments). Given that, the industry is a high ROIC Industry with few dominant players,

the stocks downside is protected to certain extent. However, to protect a further de-

rating the company has to exhibit all the characteristics of a defensive nature, which

implies that its R&D efforts have to fructify and aid company fortify the leadership

position. At current juncture, the Two-wheeler market is clearly divided between Hero

motors, Honda, TVS motors & Bajaj Auto. While the latter two players are trying to hold

onto the market-share, with exports & pricing strategy Hero Motors is trying to get in

lines of the players like Honda. Thus, we believe that R&D efforts of the company have

to be delivery before this de-rating can be arrested. Company expects its R&D efforts

to be clearly visible in next 4-5 years. However, given that the company’s has a strong

cash on balance sheet and high ROE of business, enables higher dividend payout, we

believe that further underperformance from here on should be restricted from here-on,

even for long-term buyers. Hence, we recommend a HOLD.

Company Background

Hero Motors, one of the largest player in the Industry in the two-wheeler industry (37%

market share as onFY2018. In fact, Hero Motors is the largest Motorcycle Company in

the world with the installed capacity of 84mn as on FY2018. The company has invested

It has already invested around US$125mn in setting up an R&D Center at Jaipur and

spends around 1.5-2.0% of its sales on R&D, which is a big amount been invested by an

Indian two wheeler company in the R&D set-up. Led by Dr Markus Braunsperger (CTO)/

25 years of R&D experience in BMW, Germany. Engaged 700+ automotive experts with

global, regional expertise across six nationalities. Company plans to launch at least 1-2

products every year for next 4-5 years

March 27, 2019

5

Hero Motors | Auto

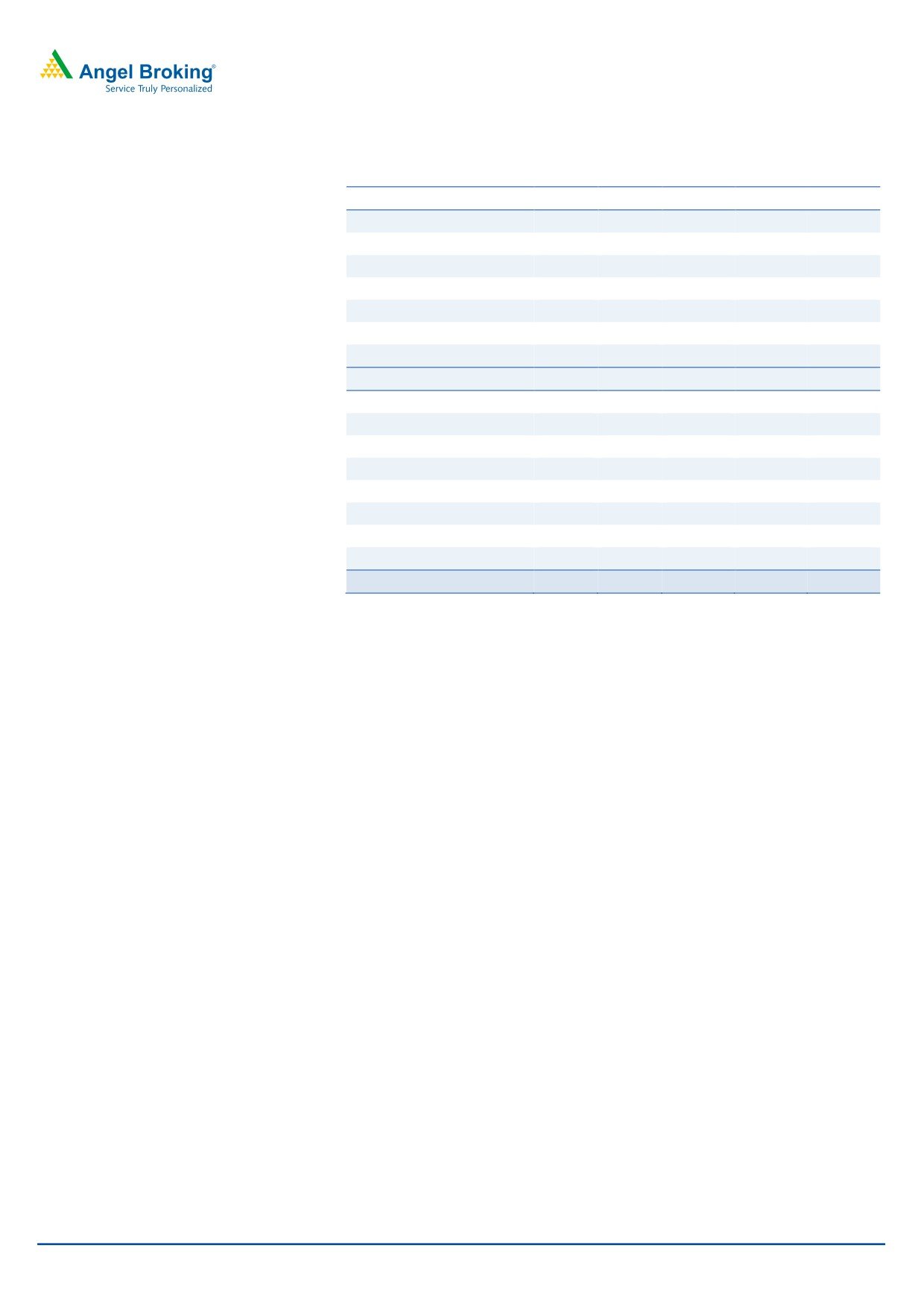

Profit & Loss statement (Consolidated)

Y/E March (`cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Net Sales

28,457

28,610

32,458

34,655

37,739

Other operating income

6

6

4

4

4

Total operating income

28,463

28,617

32,463

34,660

37,743

% chg

3.3

0.5

13.4

6.8

8.9

Total Expenditure

24,059

24,034

27,133

29,621

32,142

Net Raw Materials

19,358

19,019

21,996

23,878

25,927

Other Mfg costs

332

319

381

407

443

Personnel

1,339

1,432

1,584

1,821

2,094

Other

2,750

2,840

2,806

2,996

3,263

R&D Expenses

279

425

367

520

415

EBITDA

4,398

4,576

5,325

5,034

5,597

(% of Net Sales)

15.5

16.0

16.4

14.5

14.8

Depreciation& Amortisation

443

502

575

628

690

EBIT

3,954

4,074

4,750

4,406

4,907

Interest & other Charges

15

27

31

8

8

Other Income

314

738

423

669

720

Recurring PBT

4,224

4,791

5,146

5,072

5,624

Extraordinary Expense/(Inc.)

(127.4)

(94.0)

(145.8)

(145.8)

(145.8)

PBT (reported)

4,351

4,885

5,292

5,218

5,770

Tax

1,274.7

1,339.1

1,569.9

1,669.7

2,019.4

PAT (reported)

3,077

3,546

3,722

3,548

3,750

Basic EPS (Rs)

151.0

172.9

179.1

170.4

180.5

March 27, 2019

6

Hero Motors | Auto

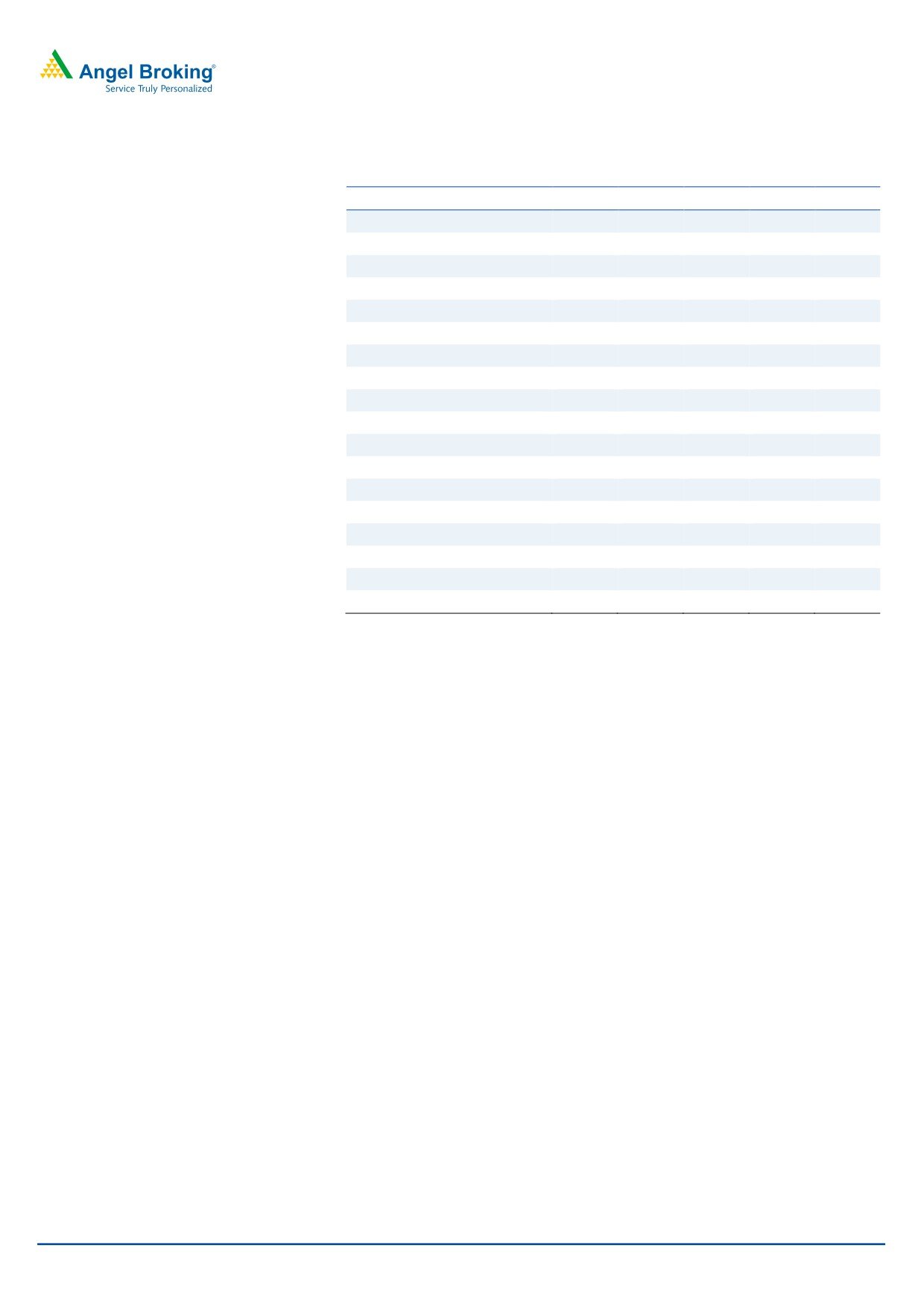

Balance sheet (Consolidated)

Y/E March (` cr)

FY2016 FY2017

FY2018 FY2019E FY2020E

Equity Share Capital

40

40

40

40

40

Reserves & Surplus

8,794

10,276

11,932

12,945

14,020

Shareholders Funds

8,834

10,316

11,971

12,985

14,059

Minority Interest

55

67

93

93

93

Long-term provisions

68

76

119

119

119

Total Loans

232

261

228

228

228

Deferred Tax Liability

222

469

582

582

582

Total Liabilities

9,411

11,188

12,993

13,888

14,962

Net Block

3,784

4,599

4,961

5,533

6,042

Capital Work-in-Progress

653

581

355

355

355

Investments

4,502

6,066

7,669

7,985

8,570

Long-term loans and advances

1,126

1,039

999

999

1,067

Current Assets

2,832

3,026

3,411

3,716

4,047

Current liabilities

3,485

4,124

4,403

4,701

5,119

Net Current Assets

(654)

(1,098)

(992)

(985)

(1,072)

Non Current Assets

-

Total Assets

9,411

11,188

12,993

13,888

14,962

March 27, 2019

7

Hero Motors | Auto

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2016 FY2017 FY2018 FY2019E FY2020E

Profit before tax

4,351

4,885

5,292

5,218

5,770

Depreciation

443

502

575

628

690

(Inc)/Dec in Working Capital

218

374

(103)

83

184

Less: Other income

314

738

423

669

720

Direct taxes paid

(1,275)

(1,339)

(1,570)

(1,670)

(2,019)

Cash Flow from Operations

3,424

3,684

3,771

3,590

3,905

(Inc.)/Dec.in Fixed Assets

(1,111)

(1,190)

(655)

(1,200)

(1,200)

(Inc.)/Dec. in Investments

(1,383)

(1,565)

(1,603)

(316)

(585)

Other income

314

738

423

669

720

Cash Flow from Investing

(2,181)

(2,016)

(1,835)

(846)

(1,065)

Issue of Equity

1

1

3

-

-

Inc./(Dec.) in loans

132

29

(33)

-

-

Dividend Paid (Incl. Tax)

(1,398)

(1,737)

(1,698)

(2,388)

(2,530)

Others

(59)

39

(151)

(158)

(281)

Cash Flow from Financing

(1,324)

(1,668)

(1,879)

(2,546)

(2,811)

Inc./(Dec.) in Cash

(80)

(1)

57

197

29

Opening Cash balances

155

75

74

131

328

Closing Cash balances

75

74

131

328

357

March 27, 2019

8

Hero Motors | Auto

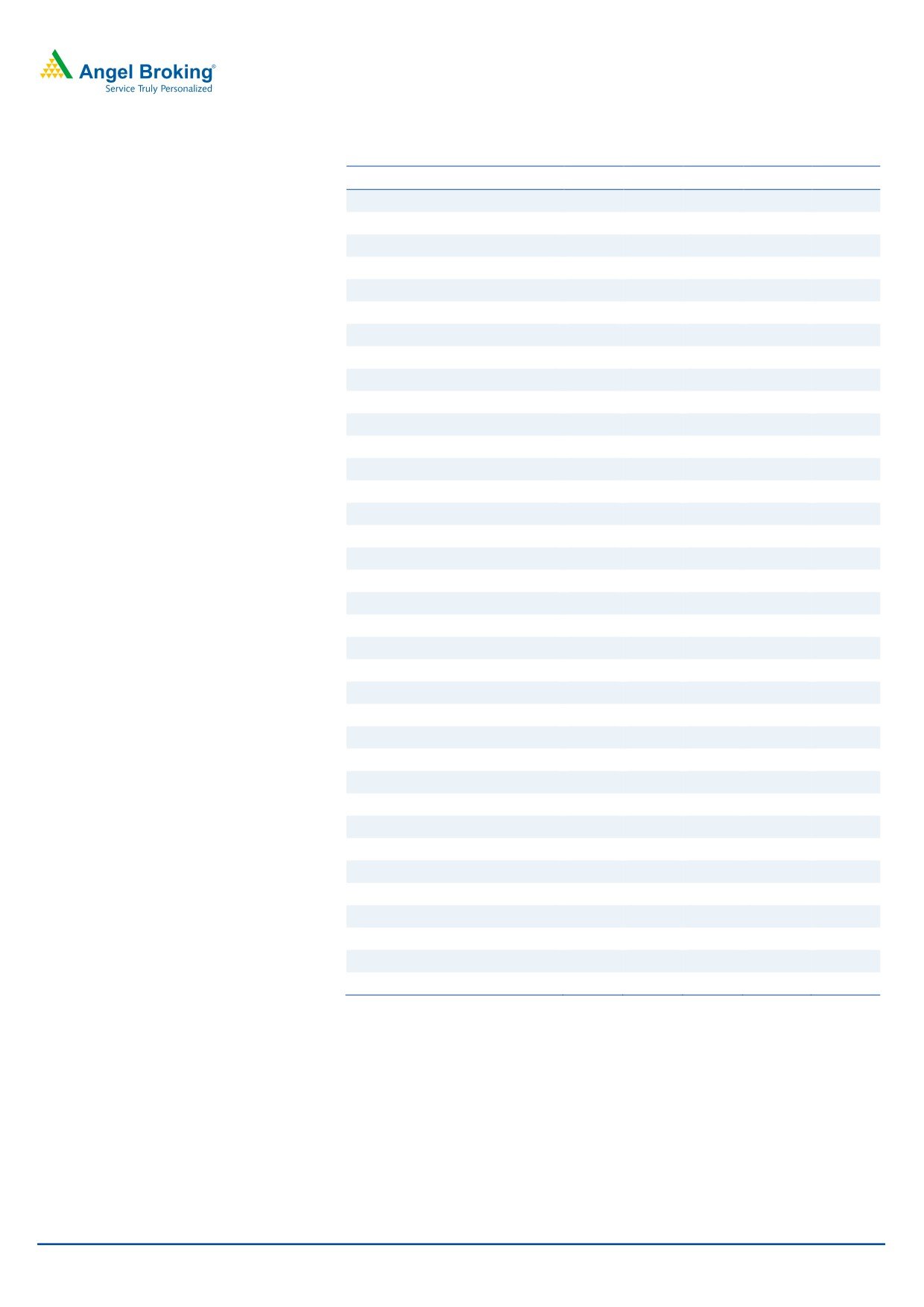

Key ratios

Y/E March

FY2016

FY2017

FY2018

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

17.1

14.9

14.4

15.1

14.3

P/CEPS

14.6

12.7

12.0

12.3

11.6

P/BV

5.8

5.0

4.3

4.0

3.7

Dividend yield (%)

2.8

3.3

3.7

4.0

4.2

EV/Sales

1.8

1.8

1.6

1.5

1.4

EV/EBITDA

11.7

11.3

9.7

10.2

9.2

EV / Total Assets

5.5

4.6

4.0

3.7

3.4

Per Share Data (Rs)

EPS (Basic)

151.0

172.9

179.1

170.4

180.5

EPS (fully diluted)

151.0

172.9

179.1

170.4

180.5

Cash EPS

176.3

202.7

215.2

209.1

222.4

DPS

72.0

85.0

95.0

102.2

108.3

Book Value

442.4

516.6

599.5

650.2

704.0

Dupont Analysis

EBIT margin

13.9

14.2

14.6

12.7

13.0

Tax retention ratio

70.7

72.6

70.3

68.0

65.0

Asset turnover (x)

7.7

7.0

8.0

7.9

7.7

ROIC (Post-tax)

76.0

72.1

82.3

68.6

65.1

Cost of Debt (Post Tax)

6.2

8.0

8.9

2.2

2.1

Leverage (x)

(0.0)

0.0

0.0

(0.0)

(0.0)

Operating ROE

75.6

72.5

82.5

68.3

64.5

Returns (%)

ROCE (Pre-tax)

49.1

39.6

39.3

32.8

34.0

Angel ROIC (Pre-tax)

55.2

42.9

41.6

34.4

35.7

ROE

39.2

36.1

32.1

27.3

26.7

Turnover ratios (x)

Asset Turnover (Gross Block)

3.3

2.9

2.9

2.9

2.8

Inventory / Sales (days)

49

53

57

58

58

Receivables (days)

52

47

33

33

33

Payables (days)

57

58

53

52

52

Working capital cycle (ex-cash) (days)

(12)

(14)

(14)

(13)

(13)

Solvency ratios (x)

Net debt to equity

0.0

0.0

(0.0)

(0.0)

(0.0)

Net debt to EBITDA

0.0

0.0

(0.0)

(0.0)

(0.0)

Interest Coverage (EBIT / Interest)

270.7

149.3

154.2

585.9

652.5

March 27, 2019

9

Hero Motors | Auto

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Hero Motor

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

March 27, 2019

10